I'm a surveyor and part of my job is performing unbiased appraisals, which hold up to scrutiny in court.

Are you looking at a boat or a yacht? Do you plan on having it surveyed?

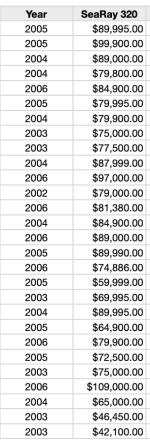

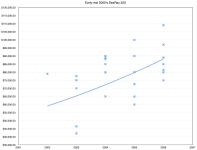

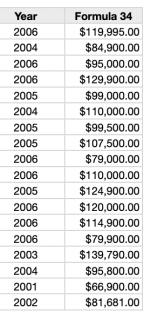

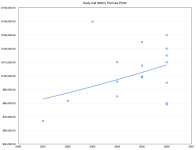

The book values are just the opinion of the book value company. They aggregate data, sprinkle their fairy dust on it, and come up with a number. Sometimes it is somewhat accurate, other times it's not. Buc usually assigns a high value, NADA/JD Power is usually in the middle, ABOS/Price Digest is usually low. But it's just a book value, and does not account for the condition of the vessel, which is everything. When I do appraisals, I try not to look at book values unless there is simply no other reliable data available. Anybody can point to a "book value"; appraisals take work and methodology.

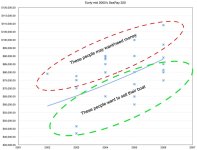

The market changed completely during covid. People purchased boats way over what they were actually worth at the time. The market peaked approximately in late 2021, and it's been a downhill ride since then. The people who purchased boats then, especially if they took out a loan, are taking an absolute bath on them, which is why they would rather hold the boat, make the monthly payments, versus selling low/what the actual today's value is. Other times, they may not be able to sell the boat and satisfy the lien at the same time if they do not have the cash on hand. Right now, a specific segment of the recreational boating market has absolutely crashed; people just don't want to admit it because doing so would be admitting they made a poor decision during covid by overpaying when everyone (ahem, me) told them at the time.

Finally, brokers are idiots, and they are not your friend. If they were able to do something useful with their lives, they wouldn't be selling used boats. They get a fixed percentage of the sale price of the vessel, which means they are incentivized by you overpaying for a boat.

What are you looking at exactly?